Introduction: From "Vein-to-Vein" to "Off-the-Shelf" – The Era of In Vivo CAR-T Has Arrived

Since the global approval of Kymriah, the first CAR-T product, in 2017, cell therapy has fundamentally reshaped the treatment paradigm for hematologic malignancies. At the same time, there has been strong anticipation that CAR-T technology might ultimately provide a definitive solution for cancer. However, this “living drug” has also introduced unprecedented challenges in manufacturing, pricing, and accessibility. The intricate production chain—spanning plasmids, viral vectors, and cells—combined with the weeks-long “vein-to-vein” timeline and personalized cell preparation, has collectively resulted in prohibitive costs. Prices often reach millions of RMB or hundreds of thousands of U.S. dollars, preventing CAR-T products from being broadly deployed to deliver this cutting-edge therapy to larger patient populations.

Against this backdrop, in vivo CAR-T technology has emerged, presenting a disruptive vision: miniaturizing the complexity of a cell engineering laboratory and delivering it directly into the patient’s body, thereby enabling in situ modification of T cells. In this model, every step traditionally performed ex vivo is instead completed inside the patient, not only drastically simplifying the treatment workflow but also heralding a new era of truly “off-the-shelf” in vivo cell therapy.

Even more compelling, in vivo CAR-T addresses the inherent limitations of conventional ex vivo CAR-T. It can function dynamically within the dense tumor microenvironment while avoiding the risks associated with lymphodepletion preconditioning. This endows it with tremendous potential in addressing two major areas of unmet clinical need: solid tumors and autoimmune diseases. From 2024 through 2025, global pharmaceutical leaders (Big Pharma) have made unprecedented investments and acquisitions to position themselves in this frontier, igniting an “arms race” around the next generation of cell therapies.

January 2024 - Umoja Biopharma Completes Series C Financing

Umoja Biopharma announced the completion of a $100 million Series C financing round to advance its proprietary in vivo CAR-T platform. The company employs a lentiviral vector–based VivoVec technology designed to achieve precise in vivo T cell modification. Its lead asset, UB-VV400, has already entered clinical development.

February 16, 2024 - Astellas Partners with Kelonia

Astellas (through its subsidiary Xyphos Biosciences) entered into a research collaboration and license agreement with Kelonia Therapeutics valued at up to $800 million. The collaboration aims to combine Kelonia’s iGPS™ (in vivo Gene Placement System) with Xyphos’ ACCEL™ platform to jointly develop in vivo CAR-T therapies targeting multiple cancers.

November 20, 2024 - Novartis Collaborates with Vyriad

Novartis, a pioneer in the CAR-T field, established a strategic collaboration with Vyriad, Inc. to co-develop in vivo CAR-T therapies based on a lentiviral vector platform. Although financial terms were not disclosed, this partnership highlights Novartis’ active expansion into next-generation “off-the-shelf” technologies while reinforcing its leadership in CAR-T.

March 17, 2025 - AstraZeneca Acquires EsoBiotec

AstraZeneca announced the acquisition of Belgian private company EsoBiotec for $1 billion, gaining access to its proprietary ENaBL™ platform. This platform leverages third-generation immune-shielded lentiviral vector technology for the development of in vivo CAR-T therapies. Its first candidate, ESO-T01, which targets BCMA, has already entered clinical trials for multiple myeloma.

May 13, 2025 - Stylus Medicine Secures Investment from Industry Leaders

Stylus Medicine announced the completion of an $85 million Series A financing round, with participation from major pharmaceutical companies including Eli Lilly, Johnson & Johnson, and Chugai Pharmaceutical. The company is focused on advancing next-generation in vivo CAR-T therapies by leveraging its expertise in genome engineering and chromatin regulation technologies.

June 30, 2025 - AbbVie Makes a Major Bet on the LNP Route

AbbVie announced the acquisition of Capstan Therapeutics for up to $2.1 billion. At the core of this deal is Capstan’s targeted lipid nanoparticle (tLNP) platform and its lead anti-CD19 in vivo CAR-T candidate. The acquisition is regarded as a strong industry endorsement of the potential of the LNP route in the in vivo CAR-T field.

August 21, 2025 - Gilead (Kite) Acquires Interius

Kite, the cell therapy subsidiary of Gilead Sciences, announced the acquisition of Interius BioTherapeutics for $350 million. Interius specializes in the development of innovative in vivo CAR-T platforms. This acquisition further strengthens Kite’s leadership in cell therapy and marks its formal entry into the in vivo CAR-T space.

These capital-intensive moves, often valued in the hundreds of millions to billions, not only validate the clinical promise of in vivo CAR-T but also signal a critical turning point in its transition from laboratory research to industrial-scale deployment.

The Battle of Delivery Routes: Blitzkrieg vs. Protracted War

Currently, the core challenge of in vivo CAR-T lies in how to efficiently and safely deliver CAR genes to T cells in the body. Mainstream strategies are mainly divided into two camps: the non-viral route using lipid nanoparticles (LNP) as carriers, and the viral vector route represented by lentiviruses.

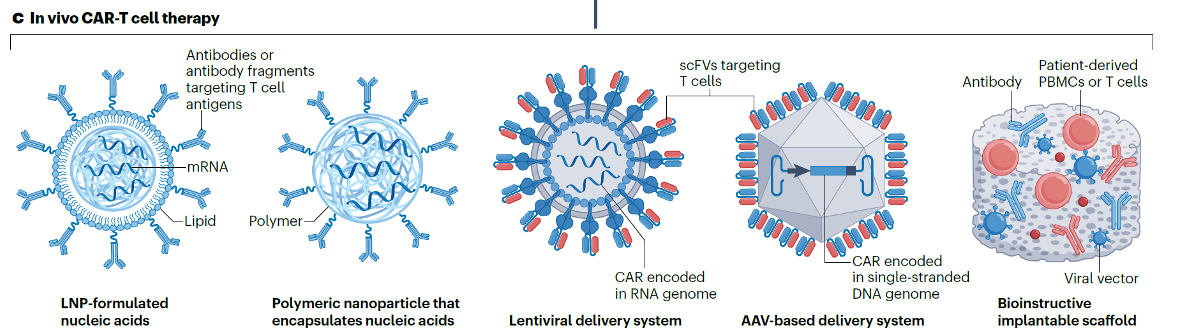

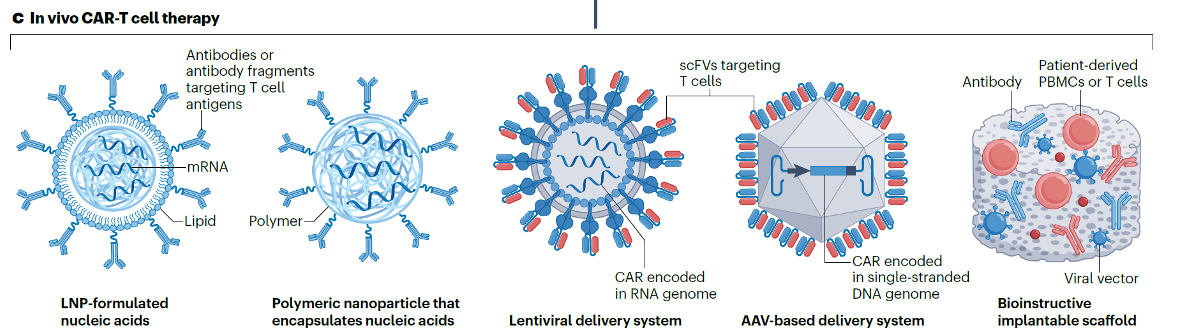

To achieve precise in vivo T cell modification, the delivery vector is the lifeline of the entire technology. Currently, the technical routes used in the industry can be divided into five types, including:

For a detailed discussion of each technical route, please refer to the original article: Yan-Ruide Li, et al. In vivo CAR engineering for immunotherapy, Nature Reviews Immunology.

Although no single table in the literature can perfectly cover comparisons across all dimensions, by synthesizing multiple cutting-edge reviews, we can outline the core differences between the two technical routes:

LNP-mRNA Route

- Advantages: Relatively fast production; non-viral and non-integrative (theoretically eliminating the risk of insertional mutagenesis); potentially lower immunogenicity.

- Disadvantages: Transient expression requiring potential repeat dosing; relatively low transduction efficiency; specificity and efficiency of T cell targeting in vivo remain major challenges.

Lentiviral Vector (LV) Route

- Advantages: Stable genomic integration enables long-term CAR expression, laying the foundation for long-term efficacy; high transduction efficiency; relatively mature technology platform.

- Disadvantages: Potential risk of insertional mutagenesis (though effectively managed through quality control measures in ex vivo therapies); relatively complex production process; may trigger immune responses against the viral vector.

In essence, if the LNP-mRNA route can be regarded as a “blitzkrieg” aimed at rapidly controlling disease progression, the lentiviral route represents a “protracted war” focused on durable benefit. Neither is absolutely superior; rather, their applicability is determined by clinical context, with outcomes defined by the core requirements of different disease indications.

I. Cancer Therapy: Durability Reigns, but Safety Cannot Be Compromised

Whether for liquid tumors such as leukemia or solid tumors such as pancreatic cancer, the dual goals of tumor eradication and recurrence prevention are paramount. However, the balance between durability and safety varies considerably by scenario.

LNP-mRNA Advantages:

- High safety: Particularly suitable for cases where the target has "on-target, off-tumor" toxicity (low expression of the target also exists in normal tissues). Since CAR expression is transient, even if severe cytokine release syndrome (CRS) or neurotoxicity occurs, the toxicity is reversible and controllable.

- Rapid deployment: Suitable for highly aggressive tumors where immediate disease control.

- Repeatable administration: Allows multiple courses of treatment as needed to sustain or reactivate anti-tumor responses.

LNP-mRNA Disadvantages:

- Insufficient durability: Sustained CAR-T persistence is critical for tumor clearance and relapse prevention. The transient nature of mRNA may lead to short-lived effects, allowing tumor recurrence.

- Lack of memory formation: Difficulty in establishing memory CAR-T cells results in inadequate long-term immune surveillance.

Lentiviral Vector Advantages:

- Strong durability: Can establish long-term, even lifelong, CAR-T cell populations, providing sustained tumor killing and recurrence prevention – the foundation for the success of current ex vivo CAR-T therapies.

- Memory cell formation: Modified T cells can differentiate into memory T cells, providing long-term immune protection.

Lentiviral Vector Disadvantages:

- Safety risks: Although the risk of integration mutagenesis has been reduced through improvements, it theoretically persists. Once severe CRS occurs, CAR expression cannot be quickly halted to alleviate symptoms.

- Manufacturing and cost: The cost and quality control of in vivo lentiviral vector production are major challenges.

Conclusion: For cancer therapy, the durability advantage of lentiviral vectors currently outweighs alternatives. However, LNP-mRNA serves as a critical complementary approach in scenarios demanding exceptionally high safety—for example, solid tumors with highly toxic targets. Notably, among the seven major transactions highlighted earlier, all except Stylus and Capstan pursued lentiviral platforms. The recent decision by Kite further strengthened industry recognition of the lentiviral route in in vivo CAR-T.

II. Autoimmune Diseases: Controllability Matters More Than Permanence

For autoimmune conditions such as lupus erythematosus and multiple sclerosis, the therapeutic principle is not eradication but regulation—suppressing hyperactive immunity without abolishing normal function or leaving long-term risks. Here, the divergence between LNPs and lentiviruses becomes one of appropriate versus inappropriate fit.

LNP-mRNA Advantages:

- Controllability: Autoimmune diseases often require intermittent or adjustable therapy. LNPs allow on-demand dosing during disease flares and discontinuation during remission, mimicking conventional drug administration rather than permanently altering the immune system.

- Safety: Avoids long-term uncertainties caused by permanent genomic modifications, which is particularly important for young patients requiring long-term treatment.

LNP-mRNA Disadvantages: May require frequent administration to maintain efficacy, affecting patients’ quality of life.

Lentiviral Vector Advantages:

- One-and-done potential: A single treatment may induce long-term remission or even functional cure, greatly improving patient adherence.

- Sustained modulation: Continuous CAR (e.g., CAARs targeting autoreactive B cells) expression provides uninterrupted immune regulation.

Lentiviral Vector Disadvantages:

- Risk of over-suppression: Permanently persistent inhibitory CAR-T cells may lead to broad immunosuppression, heightening infection and tumor risk.

- Irreversibility: If treatment strategies need to be adjusted (e.g., new targets emerge or adverse reactions occur), modified cells cannot be "recalled".

Conclusion: For autoimmune diseases, the controllability and safety advantages of LNP-mRNA may be more significant. Treating the disease as a controllable drug rather than permanent cell modification is more attractive.

The Invisible Battlefield: The True Bottleneck of In Vivo CAR-T – CMC

In vivo CAR-T shifts the complexity of treatment from the hospital end to the drug production end. Regardless of the delivery vector chosen, the maturity, scalability, and cost of its Chemistry, Manufacturing, and Controls (CMC) will directly determine whether this technology can truly move from the laboratory to the broad market.

Industrial Challenges and Technological Breakthroughs of LNP-mRNA

The preparation of LNPs requires precise control of lipid self-assembly. The mainstream laboratory method is microfluidics, which allows accurate mixing of LNPs with mRNA and achieves encapsulation efficiencies above 90%. However, when scaled to GMP production, equipment size severely limits throughput (each single channel processing only a few liters per hour), and lipid precipitation frequently clogs chips—leading to yield fluctuations exceeding 30% between batches. Pfizer studies further revealed that air entrainment during large-scale mixing induces structural rearrangements of LNPs, reducing mRNA encapsulation efficiency by more than 30%.

The ethanol injection method, while more suitable for industrialization and widely used by CDMOs, also faces challenges. Minor fluctuations in parameters such as mixing speed, pH, or lipid ratios broaden particle size distribution and reduce encapsulation efficiency by over 20%. Additional downstream steps—such as dilution and ultrafiltration—further increase process complexity, with each step compounding an estimated 3% loss of activity.

Moreover, the fragile lipid bilayer structure adds to the difficulty of scale-up. In targeted modification scenarios such as antibody conjugation, antibody density must be precisely controlled (excess density induces phagocytosis, while insufficient density compromises targeting). Yet in mass production, conjugation efficiency often fluctuates by more than 15%, exposing LNPs to shear stress and damaging their structural integrity—ultimately impairing precise delivery.

Currently, ProBio has developed a scalable platform integrating “surface conjugation + post-insertion methods” to address core bottlenecks in LNP conjugation for large-scale production, providing a key technological foundation for commercialization of LNP-based CAR-T. Nonetheless, further efforts are required in clinical validation, long-term stability, cost control, and CAR-T specificity optimization to fully support the transition of in vivo CAR-T from clinical development to commercialization.

Process Bottlenecks and Breakthroughs in Large-Scale Lentiviral Vector (LVV) Production

The industrial-scale production of LVVs currently faces three critical bottlenecks: purity, consistency, and scalability.

- High Purity Requirements

Since LVVs are directly administered into the human circulatory system, they must meet an “in vivo safety grade” purity standard. Residual impurities—including undigested plasmids, host cell proteins, cell debris, and defective viral particles—are difficult to completely remove through purification. These contaminants may provoke non-specific immune responses or cause off-target effects and functional abnormalities, posing significant safety risks.

- Strict Batch Consistency Requirements

In vivo administration requires LVVs to exhibit highly consistent viral titers, transduction efficiencies, and targeting capabilities across batches. Traditional transient transfection, however, suffers from the inherent randomness of plasmid uptake and unstable expression timing, leading to significant variability in critical quality attributes (CQAs). This undermines both efficacy predictability and regulatory compliance.

- Feasibility Challenges in Large-Scale Production

In vivo CAR-T aims to serve broader patient populations, demanding industrial-scale LVV production. Yet transient transfection processes struggle with reduced functional titers and sharply rising costs upon scale-up. For example, when scaling from a 10L to a 100L bioreactor, effective titers can drop by more than 45%, making stable clinical and commercial supply infeasible.

The mainstream multi-plasmid transient transfection approach, by its very nature of being non-integrative and temporary, cannot overcome these challenges.

- Purity: A large amount of residual plasmids, transfection reagents, and cell degradation products after transfection have similar physical properties to viral particles, making complete separation difficult in downstream purification.

- Consistency: Plasmid uptake and expression levels are significantly affected by cell status and operating parameters, leading to large quality differences between batches.

- Scalability: Transient transfection not only relies on large quantities of GMP-grade plasmids but also has far lower yield and scalability than industrial requirements, failing to support future commercial applications.

To fundamentally solve the bottlenecks of LVV production, EurekaBio is actively exploring stable producer cell line construction technology. This strategy achieves controllable and efficient viral particle production by stably integrating viral components into the host cell genome.

- Stable Integration + Inducible Regulation for Purity: Using transposon-mediated genomic integration, components such as gag/pol, rev, envelope proteins, and targeting molecules are stably inserted into the cell genome. An inducible promoter is also adopted to achieve "separation of cell expansion and vector production", significantly increasing the proportion of intact viral particles and reducing the generation of defective particles.

- High-Performance Clone Screening + Master Cell Banks for Consistency: Leveraging high-throughput automated platforms (such as EurekaBio’s EuBioX system), thousands of candidate clones are screened to evaluate monoclonality, titer, and transduction efficiency, ultimately establishing a Master Cell Bank (MCB) to ensure consistency and standardization at the production source.

- Process Compatibility + Scalability Potential: Stable cell lines can achieve high-density growth in both adherent and suspension cultures, with yields significantly higher than transient transfection (some data show a 20-fold increase). They are highly compatible with downstream purification processes and can be easily scaled up to cGMP-level production, meeting large-scale supply demands from clinical research to commercialization.

In summary, the stable producer cell line platform not only improves the safety, consistency, and scalability of LVVs at the source but also provides a solid technical foundation for the clinical translation and industrialization of in vivo CAR-T therapies. In the future, continuous optimization and innovation in this direction will be key to promoting the commercial success of the lentiviral delivery route for in vivo CAR-T.

Who Will Define the Industrial Standards for In Vivo CAR-T?

In vivo CAR-T is undoubtedly one of the most exciting cutting-edge directions in the cell therapy field, carrying the hope of making "sky-high-priced" therapies more accessible. In this race toward the future, the choice of delivery vector is the first critical fork determining the success of a technical route. LNPs have attracted significant attention due to their flexibility and success in other fields, while lentiviral vectors, with their unparalleled potential for long-term expression, seem to be more aligned with the original intention of CAR-T therapy – pursuing long-term control and even cure.

As pioneers such as EsoBiotec and Umoja have advanced in vivo CAR-T therapies to the clinical stage, initially verifying their feasibility, a more severe industrialization issue has emerged: Can the sophisticated processes widely used in laboratories today support the huge future market demand? This laboratory-based production model, with its inherent high costs and batch-to-batch instability, is becoming a Sword of Damocles hanging over the commercialization of these innovative therapies.

Therefore, the future of the industry will inevitably shift from efficacy to manufacturing. How will these cutting-edge companies bridge the gap from clinical sample preparation to large-scale commercial production? Ultimately, the entities that can define industry standards may be those that are the first to solve this manufacturing dilemma and help place innovative therapies firmly on the shelf.

.jpg)